This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Instant Payouts

Brite offers two ways of creating withdrawals, allowing the customer to receive the funds instantly. Withdrawals through Brite can be done via either using the Brite Client or directly through the API.

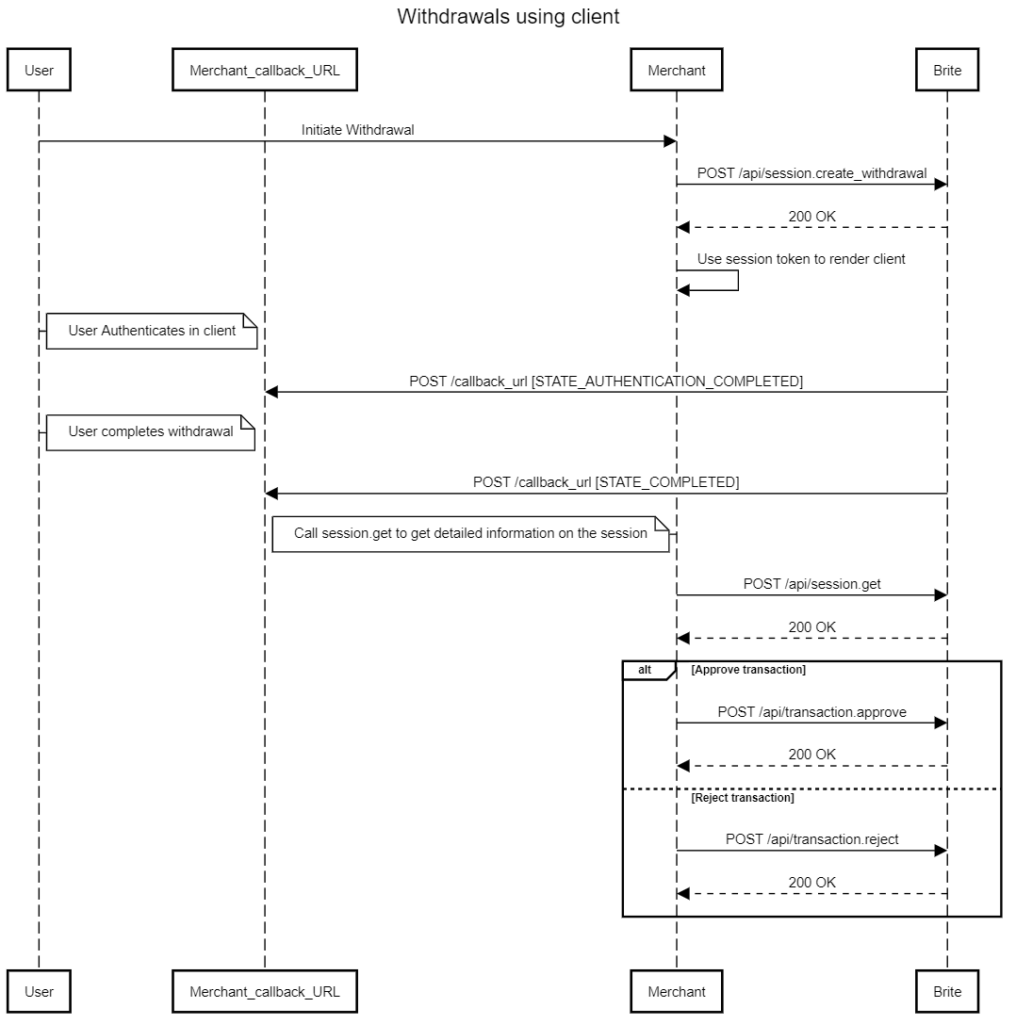

Client Withdrawal

In the Brite Client, the user can select their preferred account in different ways:

- By selecting their bank, authenticating themselves and finally selecting one of their accounts.

- By entering their account number manually

Once bank account is selected, Brite will automatically create a payout to that account and notify the user when they can expect the funds to arrive.

Create a withdrawal session by calling the sessions.create_withdrawal endpoint.

The hint parameter will pre-select a bank account for the user with the option to select another account. deeplink_redirect is used for correct redirection after bankID approval for mobile devices. The statement_reference is used for setting the bank statement. This not available in Sweden or Finland but mandatory in Germany. Use the closed_loop parameter to lock the account selection and only allow the pre-defined bank account. The merchant_reference is set by the merchant. Approval_required is used to be able to have the option to approve or reject the transaction after session is complete.

{

"deeplink_redirect": "string",

"country_id": "string", // required

"statement_reference": "string", // required for DE. Not available for SE and FI

"callbacks": [

{

"url": "string", // required

"transaction_state": 1,

"session_state": 1

}

],

"hint": {

"customer_id": "string",

"bank_account_id": "string"

},

"closed_loop": {

"customer_id": "string",

"bank_account_id": "string"

},

"amount": 0, // required

"customer_firstname": "string",

"customer_lastname": "string",

"customer_dob": "string",

"customer_id": "string",

"customer_street_address": "string",

"customer_zip": "string",

"customer_city": "string",

"customer_email": "string",

"ssn": "string",

"merchant_reference": "string",

"locale": "string",

"redirect_uri": "string",

"approval_required": true,

"brand_name": "string" // required for DE

}

User proceeds with the withdrawal in the client and when the withdrawal is completed Brite sends a STATE_COMPLETE callback to the url stated for session_state; 12.

// example response

{

"url": "string",

"token": "string",

"id": "string"

}

Get session details from session.get endpoint.

If approval_required: true the flow will continue until the session is completed. And the transaction will remain in STATE_PENDING until approved or rejected

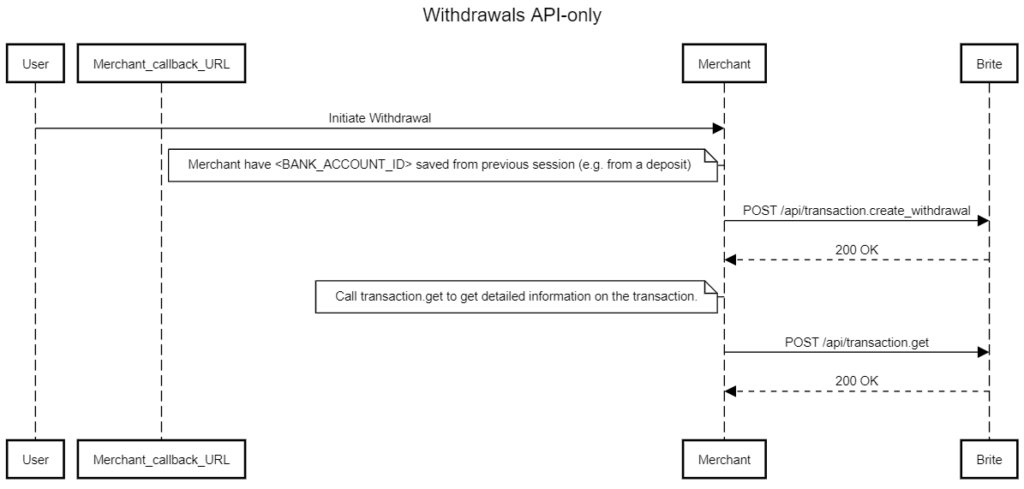

API-Only Withdrawal

The API-only solution for creating withdrawals can be used to create any type of withdrawal (including closed loop withdrawals). In order to create a withdrawal, you require a bank_account_id. The bank_account_id can be created in four ways: In a Bank account selection session, a deposit session, a withdrawal session or directly in the API using bank_account.create.

Initiate a withdrawal transaction by calling transaction.create_withdrawal. Use the bank_account_id created through any of the ways described in bank account management.

{

"callbacks": [

{

"url": "string", // required

"transaction_state": 1 // required

}

],

"amount": 0, // required

"merchant_reference": "string",

"bank_account_id": "string", // required

"statement_reference": "string" // required for DE. Not available for SE and FI

}

Get session details from transaction.get endpoint.